- Accueil

-

Projecteurs

-

E-Vision Projecteurs

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

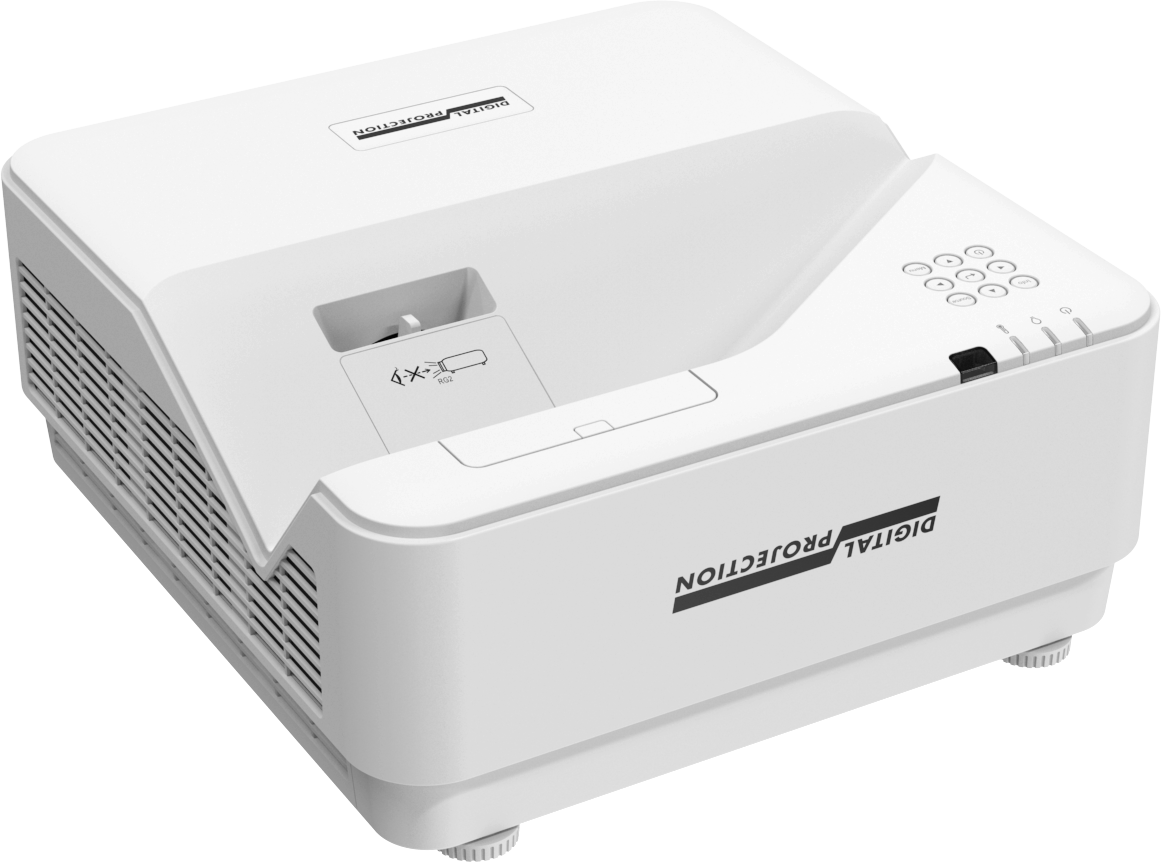

E-Vision 5000 UST

- WUXGA Resolution

- 5000 lumens

-

E-Vision 10000i 4K+ RGB

- 4K-UHD Resolution

- 10000 lumens

-

E-Vision 16000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 10000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 8000i WU

- WUXGA Resolution

- 8000 lumens

-

E-Vision Laser 15000 WU

- WUXGA Resolution

- 15000 lumens

-

E-Vision Laser 13000 WU

- WUXGA Resolution

- 13500 lumens

-

E-Vision Laser 11000 4K-UHD

- 4K-UHD Resolution

- 10500 lumens

-

E-Vision Laser 4K-UHD

- 4K-UHD Resolution

- 7500 lumens

-

E-Vision 7010-WU

- WUXGA Resolution

- 7000 lumens

-

E-Vision 6110-WU

- WUXGA Resolution

- 6100 lumens

-

-

M-Vision Projecteurs

Premium 1-Chip DLP • 18,000 - 27,000 Lumens

-

M-Vision 27000 WU

- WUXGA Resolution

- 27000 lumens

-

M-Vision 24000 WU

- WUXGA Resolution

- 24000 lumens

-

M-Vision Laser 21000 II WU

- WUXGA Resolution

- 21000 lumens

-

M-Vision Laser 18K

- WUXGA Resolution

- 18000 lumens

-

-

TITAN Projecteurs

Premium 3-Chip DLP • 26,000 - 47,000 Lumens

-

TITAN Laser 47000 WUXGA / 41000 4K-UHD

- WUXGA Resolution

- 47000 lumens

-

TITAN Laser WUXGA / 4K-UHD

- WUXGA Resolution

- 37000 lumens

-

-

Satellite MLS Projecteurs

Modular Laser System • 20,000 - 40,000 Lumens

-

Satellite Modular Laser System (MLS)

- WUXGA Resolution

- 40000 lumens

-

- INSIGHT LASER 8K (Gen II)

-

E-Vision Projecteurs

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

Logiciel

-

Vue d'ensemble Améliorez votre flux de travail en matière de projection

-

Outil de simulation en ligne Dites adieu aux devinettes

-

Multi Projection Simulator Pro Concevoir des applications complexes

-

Projector Controller II Gestion centralisée des projecteurs

-

Smart Align (add-on) Aligner et faire correspondre les couleurs des projecteurs

-

Advanced Align (add-on) Projeté à base d'ourdissage et de mélange

-

- Études de cas

-

Contact

- Accueil

-

Projecteurs

-

E-Vision Projecteurs

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

E-Vision 5000 UST

- WUXGA Resolution

- 5000 lumens

-

E-Vision 10000i 4K+ RGB

- 4K-UHD Resolution

- 10000 lumens

-

E-Vision 16000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 10000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 8000i WU

- WUXGA Resolution

- 8000 lumens

-

E-Vision Laser 15000 WU

- WUXGA Resolution

- 15000 lumens

-

E-Vision Laser 13000 WU

- WUXGA Resolution

- 13500 lumens

-

E-Vision Laser 11000 4K-UHD

- 4K-UHD Resolution

- 10500 lumens

-

E-Vision Laser 4K-UHD

- 4K-UHD Resolution

- 7500 lumens

-

E-Vision 7010-WU

- WUXGA Resolution

- 7000 lumens

-

E-Vision 6110-WU

- WUXGA Resolution

- 6100 lumens

- > View all E-Vision Projecteurs

-

-

M-Vision Projecteurs

Premium 1-Chip DLP • 18,000 - 27,000 Lumens

-

M-Vision 27000 WU

- WUXGA Resolution

- 27000 lumens

-

M-Vision 24000 WU

- WUXGA Resolution

- 24000 lumens

-

M-Vision Laser 21000 II WU

- WUXGA Resolution

- 21000 lumens

-

M-Vision Laser 18K

- WUXGA Resolution

- 18000 lumens

- > View all M-Vision Projecteurs

-

-

TITAN Projecteurs

Premium 3-Chip DLP • 26,000 - 47,000 Lumens

-

TITAN Laser 47000 WUXGA / 41000 4K-UHD

- WUXGA Resolution

- 47000 lumens

-

TITAN Laser WUXGA / 4K-UHD

- WUXGA Resolution

- 37000 lumens

- > View all TITAN Projecteurs

-

-

Satellite MLS Projecteurs

Modular Laser System • 20,000 - 40,000 Lumens

-

Satellite Modular Laser System (MLS)

- WUXGA Resolution

- 40000 lumens

- > View all Satellite MLS Projecteurs

-

- INSIGHT LASER 8K (Gen II)

-

E-Vision Projecteurs

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

Logiciel

-

Vue d'ensemble Améliorez votre flux de travail en matière de projection

-

Outil de simulation en ligne Dites adieu aux devinettes

-

Multi Projection Simulator Pro Concevoir des applications complexes

-

Projector Controller II Gestion centralisée des projecteurs

-

Smart Align (add-on) Aligner et faire correspondre les couleurs des projecteurs

-

Advanced Align (add-on) Projeté à base d'ourdissage et de mélange

-

- Études de cas

- Contact