- Home

-

Projectors

-

E-Vision Projectors

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

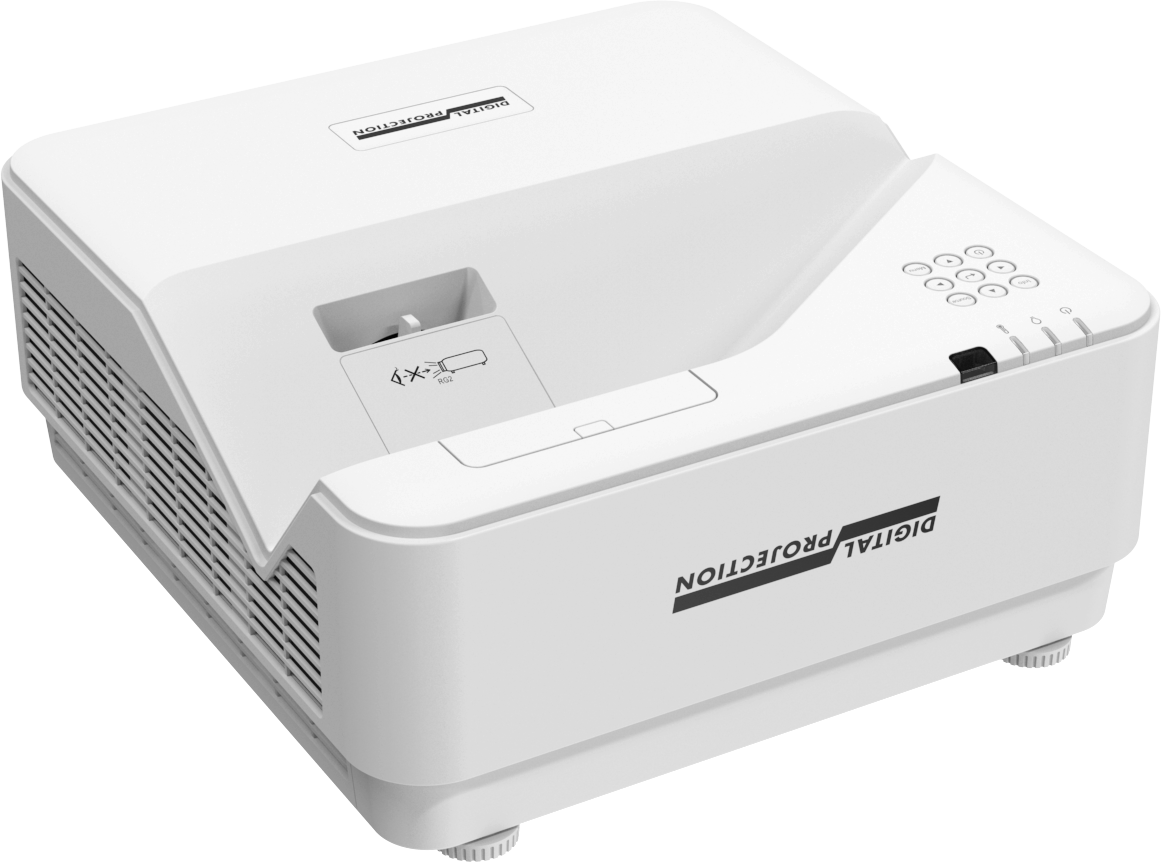

E-Vision 5000 UST

- WUXGA Resolution

- 5000 lumens

-

E-Vision 10000i 4K+ RGB

- 4K Resolution

- 10000 lumens

-

E-Vision 15000i 4K+

- 4K Resolution

- 15000 lumens

-

E-Vision 16000i WU

- WUXGA Resolution

- 16000 lumens

-

E-Vision 10000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 8000i WU

- WUXGA Resolution

- 8000 lumens

-

E-Vision Laser 15000 WU

- WUXGA Resolution

- 15000 lumens

-

E-Vision Laser 13000 WU

- WUXGA Resolution

- 13500 lumens

-

E-Vision Laser 11000 4K-UHD

- 4K-UHD Resolution

- 10500 lumens

-

E-Vision Laser 4K-UHD

- 4K-UHD Resolution

- 7500 lumens

-

E-Vision 7010-WU

- WUXGA Resolution

- 7000 lumens

-

E-Vision 6110-WU

- WUXGA Resolution

- 6100 lumens

-

E-Vision 4000 4K-UHD

- 4K-UHD Resolution

- 3800 lumens

-

-

M-Vision Projectors

Premium 1-Chip DLP • 18,000 - 27,000 Lumens

-

M-Vision 27000 WU

- WUXGA Resolution

- 27000 lumens

-

M-Vision 24000 WU

- WUXGA Resolution

- 24000 lumens

-

M-Vision Laser 21000 WU II

- WUXGA Resolution

- 21000 lumens

-

M-Vision Laser 18K

- WUXGA Resolution

- 18000 lumens

-

-

TITAN Projectors

Premium 3-Chip DLP • 26,000 - 47,000 Lumens

-

TITAN Laser 47000 WUXGA / 41000 4K-UHD

- WUXGA Resolution

- 47000 lumens

-

TITAN Laser 37000 WUXGA / 33000 4K-UHD

- 4K-UHD Resolution

- 37000 lumens

-

-

Satellite MLS Projectors

Modular Laser System • 20,000 - 40,000 Lumens

-

INSIGHT Laser 8K

-

INSIGHT LASER 8K (Gen II)

- 8K Resolution

- 37000 lumens

-

-

E-Vision Projectors

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

Software

-

Overview Upgrade your projection workflow

-

Web-based Simulator Tool Say goodbye to guesswork

-

Multi Projection Simulator Pro Design complex applications

-

Projector Controller II Centralised projector management

-

Smart Align (add-on) Align and colour match projectors

-

Advanced Align (add-on) Projector based warp and blend

-

-

Markets

- Pro AV Precision colour and performance for Pro AV venues

- Visitor Attraction Breathtaking images for the worlds best immersive attractions

- Live Events & Projection Mapping Remarkably Powerful Projectors Delivering Dazzling Brightness for any Large Venue

- Visualisation and VR Truly immersive, collaborative and interactive 3D experiences

- Simulation & Training Simulation and Training for Any Environment

- Case Studies

-

Contact Us

- Home

-

Projectors

-

E-Vision Projectors

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

E-Vision 5000 UST

- WUXGA Resolution

- 5000 lumens

-

E-Vision 10000i 4K+ RGB

- 4K Resolution

- 10000 lumens

-

E-Vision 15000i 4K+

- 4K Resolution

- 15000 lumens

-

E-Vision 16000i WU

- WUXGA Resolution

- 16000 lumens

-

E-Vision 10000i WU

- WUXGA Resolution

- 10000 lumens

-

E-Vision 8000i WU

- WUXGA Resolution

- 8000 lumens

-

E-Vision Laser 15000 WU

- WUXGA Resolution

- 15000 lumens

-

E-Vision Laser 13000 WU

- WUXGA Resolution

- 13500 lumens

-

E-Vision Laser 11000 4K-UHD

- 4K-UHD Resolution

- 10500 lumens

-

E-Vision Laser 4K-UHD

- 4K-UHD Resolution

- 7500 lumens

-

E-Vision 7010-WU

- WUXGA Resolution

- 7000 lumens

-

E-Vision 6110-WU

- WUXGA Resolution

- 6100 lumens

-

E-Vision 4000 4K-UHD

- 4K-UHD Resolution

- 3800 lumens

- > View all E-Vision Projectors

-

-

M-Vision Projectors

Premium 1-Chip DLP • 18,000 - 27,000 Lumens

-

M-Vision 27000 WU

- WUXGA Resolution

- 27000 lumens

-

M-Vision 24000 WU

- WUXGA Resolution

- 24000 lumens

-

M-Vision Laser 21000 WU II

- WUXGA Resolution

- 21000 lumens

-

M-Vision Laser 18K

- WUXGA Resolution

- 18000 lumens

- > View all M-Vision Projectors

-

-

TITAN Projectors

Premium 3-Chip DLP • 26,000 - 47,000 Lumens

-

TITAN Laser 47000 WUXGA / 41000 4K-UHD

- WUXGA Resolution

- 47000 lumens

-

TITAN Laser 37000 WUXGA / 33000 4K-UHD

- 4K-UHD Resolution

- 37000 lumens

- > View all TITAN Projectors

-

- Satellite MLS Projectors Modular Laser System • 20,000 - 40,000 Lumens

-

INSIGHT Laser 8K

-

INSIGHT LASER 8K (Gen II)

- 8K Resolution

- 37000 lumens

- > View all INSIGHT Laser 8K

-

-

E-Vision Projectors

Premium 1-Chip DLP • 3,800 - 16,000 Lumens

-

Software

-

Overview Upgrade your projection workflow

-

Web-based Simulator Tool Say goodbye to guesswork

-

Multi Projection Simulator Pro Design complex applications

-

Projector Controller II Centralised projector management

-

Smart Align (add-on) Align and colour match projectors

-

Advanced Align (add-on) Projector based warp and blend

-

-

Markets

- Pro AV Precision colour and performance for Pro AV venues

- Visitor Attraction Breathtaking images for the worlds best immersive attractions

- Live Events & Projection Mapping Remarkably Powerful Projectors Delivering Dazzling Brightness for any Large Venue

- Visualisation and VR Truly immersive, collaborative and interactive 3D experiences

- Simulation & Training Simulation and Training for Any Environment

- Case Studies

- Contact Us